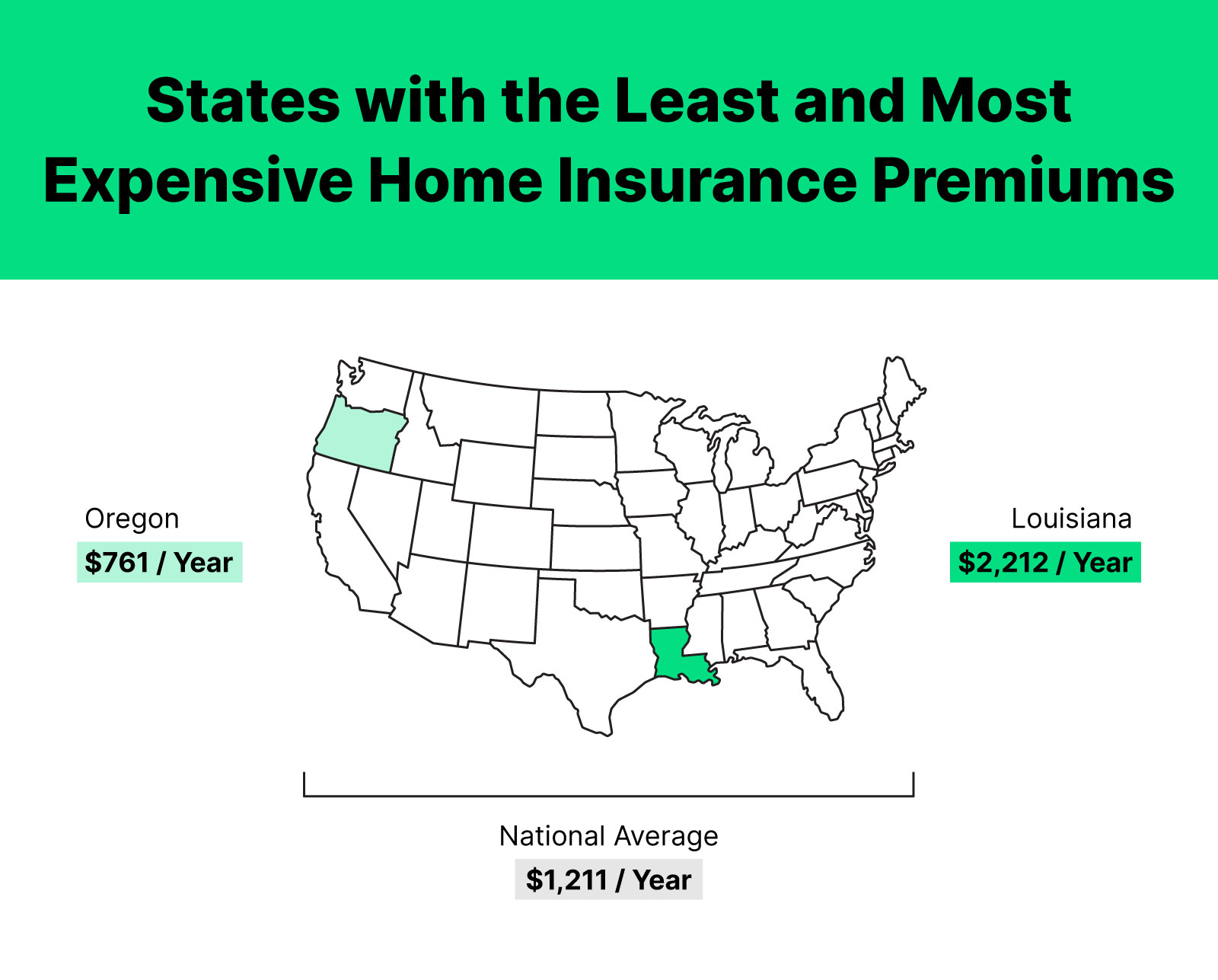

Where you live plays a factor in how much you pay for home insurance. However, your actual rates may vary depending on several factors. Year the house was built. Use this calculator to estimate the cost of homeowners insurance in 2025, and understand the factors that influence home insurance rates. Compare home insurance rates as low as $97/month and start saving money now! Learn about the factors that affect home insurance premiums. Dont overpay to be underinsured! · what determines homeowners insurance premiums? Location, the cost to rebuild your house, past claims history, how much coverage you choose and your credit are the main factors in home insurance costs. Prices are going up, insurers are pulling out of key markets, and it’s hard to know whether what you’re … Get free quotes in minutes and see how much you can save on home insurance. The national average cost of homeowners insuranceis $1,678 per year , according to our analysis. Get started by answering a few quick questions to find the … How do i estimate my home insurance cost? The cost of homeowners insurance premiums is influenced by several key factors including the location of your … Your home insurance company can figure out the estimated cost to rebuild your house. Quickly estimate your annual homeowners insurance cost with our easy-to-use home insurance calculator. Learn about monthly expenses, factors affecting premiums, and how to secure the best policy for your home. Raise your home insurance deductible. you can save on home insurance costs by raising your deductible. How much does home insurance cover? Learn how home type, claim history, and more factors can impact your rates. · the average cost of homeowners insurance in the u. s. Figuring out how much homeowners insurance should cost in 2025 can feel confusing. · compare home insurance quotes side-by-side save an average of $482/year when you shop homeowners insurance with the zebra. Find quotes for. · our home insurance calculator lets you get a home insurance estimate for your zip code at various coverage levels. · discover how much a month homeowners insurance typically costs, key factors influencing premiums, and tips for finding the best value and discounts to lower expenses. How much does home insurance cost in oklahoma? Homeowners insurance in florida: The rates for the same homeowners policy can vary substantially from one insurance company to the next, so comparing home insurance quoteswith several companies will help you find the policy you need at the most affordable price. We used data from quadrant information services, a provider of insurance data and analytics. Why should you consider homeowners insurance? And there are other coverage nee. That home insurance estimate is for a policy with $350,000 in dwelling coverage, $175,000 for personal property coverage and $100,000 in liability coverage. Youll see the average rate and the highest and lowest from major carriers for your zip. Compare home insurance quotes from progressive, allstate, liberty mutual, and other … Compare home insurance quotes from progressive, allstate, liberty mutual, and other top providers—all in one place. But how much does it actually cost? If you have the following information on hand when comparing home insurance quotes, it should be a smooth process: · homeowners insurance is a crucial aspect of protecting your most valuable asset—your home. Rates are based on zip codes across the nation for varying coverage limits, deductibles and credit. Compare 10 low rates & see how much you could save every month for home insurance Understanding the various factors that … The cheapest home insurance cost estimate is $729 a year from progressive, based on our analysis of average costs among large insurers. Compare quotes & save. Fast and reliable. Get insights into the cost of homeowners insurance. Rates vary significantly from one home insurance company to the next, so be sure to shop around w. How much homeowners insurance is on a $400,000 house? Estimate your homeowners insurance cost based on home value, location, and coverage using our cost of home insurance calculator. The true price of homeownership on average, homeowners spend $10,946 per year on maintenance, $2,003 on homeowners insurance , and $3,030 on property taxes. See full list on forbes. com Here are the average home insurance costs by state. · understand home insurance costs and coverage. That said, insurance premiums can vary widely by geography … Property use (primary residence, seasonal/vacation home or rental). Is about $2,110 a year for $300,000 worth of dwelling coverage, but rates vary by state. Get accurate results in seconds. · the average homeowners insurance policy with $300,000 in dwelling coverage costs $2,584 annually, according to compare. com data. Type of property (single family, duplex, multi-family). [1] relative to the rest of the us at … What you need to know the average cost for homeowners insurance in florida is $1,836 per year or $153 per month. The average cost of homeowners insurance in the u. s. · homeowners insurance costs an average of $2,532 per year for $300,000 in dwelling coverage. This amount should be your dwelling coverage limit. Number of stories. Compare cheap rates for your best options to save money on great coverage! · rising expenses for maintenance, insurance , and property taxes are climbing faster than household incomes, reshaping what it truly costs to own a home in today’s market. · according to the latest data, the average cost of homeowners insurance in the united states is $2,927. · forbes advisor’s home insurance calculator is a fast and simple way to calculate your home insurance costs. Is $2,424 per year for $300,000 in dwelling coverage. How much home insurance you needdepends on the cost to rebuild your house, how much personal property coverage you need, how much liability insurance you require and other factors. Style of the home. But your personal rate depends on factors like your home ’s value, coverage limits, claims history, discounts, and location. · save an average of $482/year when you shop homeowners insurance with the zebra. Why is home insurance so expensive?